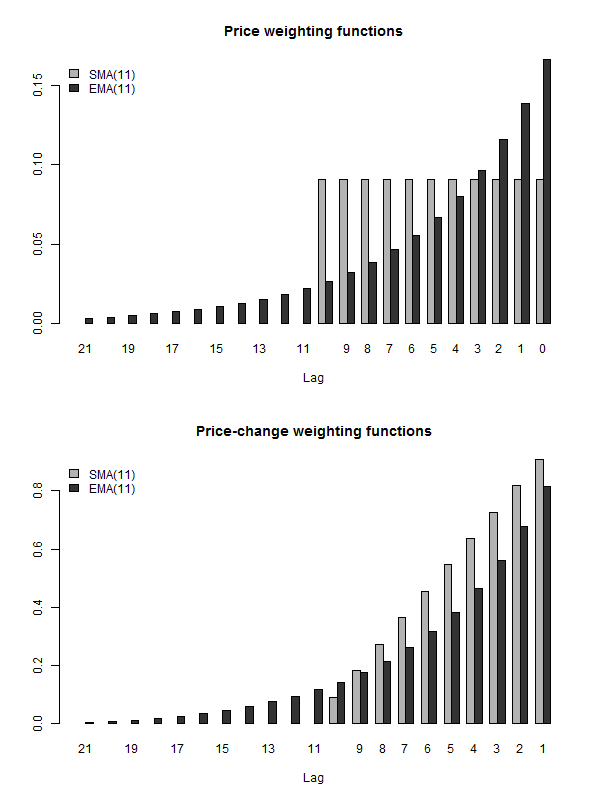

An EMA can be specified in two ways: as a percentage-based EMA, where the analyst determines the percentage weight of the latest period’s price, or a period-based EMA, where the analyst specifies the duration of the EMA, and the weight of each period is calculated by formula. The shorter the EMA period, the more weight will be applied to the most recent price. The weighting applied to the most recent price depends on the specified period of the moving average. The exponential moving average (EMA) is a weighted average of a price data which put a higher weight on recent data point. It is criticized for giving equal weight to each interval. Therefore it could lead you to enter trade some late. Its signals occur after the new movement, event, or trend has started, not before. Conversely, a downward sloping moving average with the price below can be used to signal a downtrend. When a moving average is heading upward and the price is above it, the security is in an uptrend. It is one of the best ways to gauge the strength a long-term trend and the likelihood that it will reverse. Moving average is a smoothing tool that shows the basic trend of the market. Though the daily closing price is the most common price used to calculate simple moving averages, the average may also be based on the midrange level or on a daily average of the high, low, and closing prices. For example, adding the closing prices of an instrument for the most recent 15 days and then dividing it by 15 will get you the 15 day moving average. It is calculated by summing up each interval’s price and dividing the sum by the number of intervals covered by the moving average. The simple moving average is an arithmetic mean of price data. There are several types of moving averages, but we will deal with only two of them: the simple moving average (SMA) and the exponential moving average (EMA). Moving averages (mostly EMA) are also used just like traditional support and resistance levels.It is the greatest advantage and benefit of them.

It is a common tool in technical analysis and is used either by itself or as an oscillator. A moving average makes it easier to visualize market trends as it removes – or at least minimizes – daily statistical noise. Double bottom, Double top, Triple bottom, Triple topĪ moving average is an average of a shifting body of prices calculated over a given number of days.MACD (Moving Average Convergence-Divergence).Crude oil, Natural gas rig counts – weekly report.

0 kommentar(er)

0 kommentar(er)